Do you know that real estate has long been the most common investment option in the United States – and that it is now becoming more popular than other popular investment options? In this post, you’ll know why real estate is the best investment in your life.

Real estate was ranked the best longstanding investment in a 2016 Gallup Poll[1], beating out gold, stocks and mutual funds, savings accounts/CDs, and bonds.

Real estate is the best investment choice in general. It can provide recurring passive income and, if the value rises over time, it can be a successful long-term investment. You might also incorporate it into your overall wealth-building plan.

You must, however, ensure that you are prepared to begin spending in real estate. To begin a real estate investment, you will demand to settle down a noteworthy sum of money upfront.

Buying a house, an apartment complex, or a plot of land may be costly. Not to mention the continuing maintenance costs you’ll be liable for, as well as the possibility of income gaps if you go between tenants for an extended time.

It’s the same in Australia, where the emotional satisfaction that comes with owning a home is inherently high.

Top Reasons Why Real Estate is the Best Investment to Generate Passive Income

Real estate is a valuable secure investment.

Your land will always have value, and your home will always have value. Other assets, such as stocks that can go to zero or a new car that loses value over time, can leave you among limited or no real asset amount. Homeowners insurance will protect your real estate property, so shop around for the best coverage available to ensure that your asset is covered in the worst-case scenario.

Real estate allows you to create equity

The majority of real estate is acquired with a minimal down payment and the remainder of the funds are raised by a lender by debt financing. The maximum stability of the mortgage is gradually reduced over time, at first slowly and then more quickly near the end of the amortization period. This decrease in the principal creates equity.

Real estate offers higher returns than the stock market while avoiding the stock market’s uncertainty

The amount of time you hold on to your property has historically reduced the chance of failure in real estate. If the economy increases, so does the value of your house, and you create wealth as a result. In the stock market, the risk is constant, and there are many factors beyond your control that can damage your investment. Since your property is a tangible asset, you have greater power over your investment. You can use it to generate several income streams while still enjoying capital appreciation.

Real estate can be improved Overtime

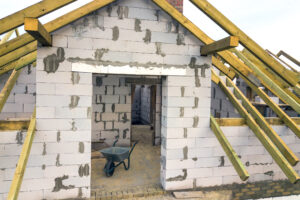

One of the most appealing features of real estate is that it can be improved. Since real estate is a real asset made of wood, brick, concrete, and glass, it is possible to increase the value of any property with a little “sweat equity” and “turn grease.” The idea is the same if the repairs are structural or cosmetic, and whether you do it yourself or employ others. You will increase the value of your property by improving it.

Real estate investments will help you diversify your portfolio

If you’ve ever discussed investing with a financial planner, you’re well aware of the value of diversification. When you diversify your portfolio, the risk is spread out. Real estate will always be a secure financial asset to diversify your portfolio’s risk. Many people have amassed wealth exclusively through real estate investments.

Real estate and retirement go together

When you buy real estate, the cash balance is lower and your mortgage principal is reduced less. The debt is paid off or paid off over time, and the cash flow improves. In several ways, it’s a forced savings program that grows in value over time, making it an ideal retirement investment because it generates more cash flow.

The cost of real estate is tax-deductible

The tax code provides for a change of reductions for typical real estate expenditures such as land upkeep, repairs, renovations, and even mortgage interest. Deductions can be used to cover wages and lower the net tax burden.

Real estate depreciates over time

Depreciation is a non-cash cost that depreciates the worth of your investment property over time, as allowed by the tax code. Your investment property, on the other hand, appreciates. The depreciation deduction enables a real estate owner to produce more positive cash flow while reporting a lower taxable income. This results in a higher return than you would expect.

Real estate can be used as a debt

Debt is the most significant benefit of real estate investing. It is the use of borrowed funds to boost an investment’s future return. When a mortgage is used to minimize the amount of investor capital needed to buy a property in a real estate transaction, it is referred to as leverage. The annual return on a $200,000 cash-purchased property with a $20,000 net cash flow is 10%.

Real estate is taxed at a lower rate.

If you sell your investment property after a year, the gain is directed to property gains tax rates, which are normally 15% or 20% determined by the individual tax bracket, which is typically lower than your tax bracket.

Bonus: The cash flow from real estate is expected

After all, operating costs and interest payments have been paid, cash flow is the investment’s exclusive spendable resources. A successful real estate investment should generate a cash flow of at shortest 6% per year.

Final Thoughts

Real estate investment necessitates a significant amount of financial capital, making it important to take extra precautions to ensure a profit or at the very least avoid significant losses.

The dynamic nature and unique hurdles of real estate, if well prepared for, may provide excellent returns to any prospective investor in the form of net operating income, equity growth, or capital appreciation.